Core Advantages of Strategic Modeling

By: Sunil Keezhangattu - Sr. Principal Consultant

Published:

April 14, 2020

Oracle Strategic Modeling in the Cloud

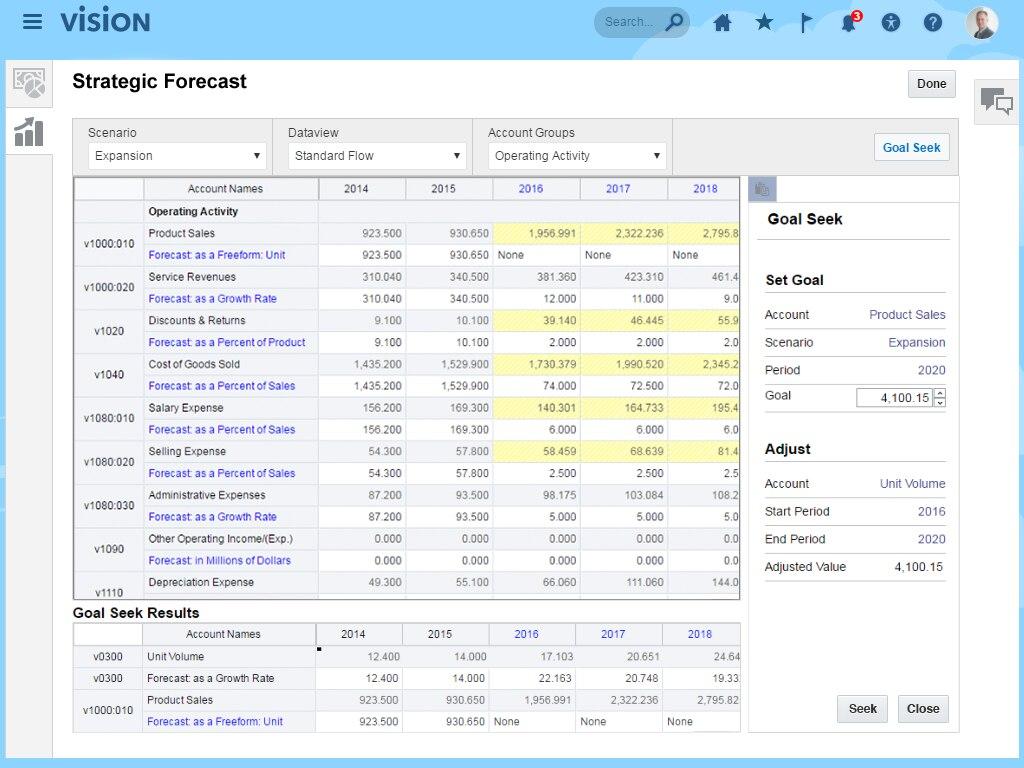

Companies and organizations rely on quick analysis of fast ever-changing business circumstances and uncertainties inherent in long range financial forecasts. As part of the Oracle EPBCS (Enterprise Planning and Budgeting Cloud System) there is a module called Strategic Modeling which can be implemented by ParadigmSES. The core advantages in having Strategic Modeling for your organization is the ability for Financial Planning and Analysis (FP&A) and Enterprise Risk Management teams to forecast Profit & Loss (P&L), Balance Sheet and Cash Flow with its tight integration with the EPM Income Statement, Balance sheet statement and Cash flow statements in the cloud. You can easily create What-If analysis to develop multiple scenarios to see the impact on a portfolio (new product, new acquisition, new purchase, new projects, new investments, etc) using the web interface or excel interface. Once the initial setup is complete, the users can easily try the different scenarios and business cases without any technical involvement. Oracle has been working on tighter integration with other modules of EPBCS allowing you to bring in Budgets and Forecasting data (short term date) for long term analysis. Utilize the robust cash flow forecasting of Strategic Modeling to understand your firm's projected cash position in future years so that you can make capital structure decisions that will ensure liquidity and optimize your credit rating.

EPBCS Capabilities

- Forecast the cash surplus available that can be re-invested and/or allocated to specific asset categories.

- Forecast interest rate fluctuations, expected market returns, realized and unrealized gains or losses on investments and total investment income.

- Able to do consolidated calculations to see a great variance in the probability matrix of what different scenarios will provide what kind of results.

- Forecast fixed or variable rate debt such as bonds or term loans and update all financials accordingly.

- Calculate current debt and accrued interest as well as amortization of bond premiums and issuance expenses.

- Convert GAAP forecasts to STAT to calculate Statutory Surplus, Risk-based Capital, TAC and other key outputs required for Risk Management purposes.

- Delivers financial intelligence that links all aspects of financial performance, from earnings potentials through working capital expenditures to capital management, taxes and capital structures to support the organizations.

Features:

- Treasury planning.

- Allowing value creation.

- Reducing an organization's cost of capital.

- Create consolidations scenarios for financial consolidations including minority interest, equity and cost methods of accounting for subsidiaries.

Risk Management

Enterprise Risk Management team would like this module as it will create strategic business models based on the business model demands (eg: tourism and hospitality, festival impact on tourism, terrorism impact, sickness outbreak, airline impact, social media impact). Providing insight into the risk impact and ability to mitigate risks in a volatile market with understanding the market pressures, understanding operations risk and the impact it has on an organization. For those who are familiar with the Hyperion Strategic Finance (HSF) which used to be packaged separately in the Hyperion suite for on-Premises module, Strategic Modeling which is the cloud version of the same system but modified for full integration in the cloud with the other financial applications. Paradigm SES can work with you to implement Strategic Modeling so that all Financial Accountants up to the CFO can look at where to divest resources and funding based on the current ever fluctuating economy. Strategic Modeling helps you to stay agile and remain one step ahead of your competition in forecasting for different eventual scenarios.

FREE CONSULTATION

Schedule your Free Consultation, to see it in action!

Contact Us!

We offer Autonomous Systems for EPM Cloud Applications such as Oracle Planning & Budgeting Cloud Service (PBCS/EPBCS), Financial Close & Consolidations Cloud Service (FCCS), Enterprise Data Management Cloud Services (EDMCS), Account Reconciliation Cloud Service (ARCS), Profitability & Cost Management (PCM) and more.