Accelerating Financial Close: How CFOs Are Transforming Week-Long Processes Into Days

By: Sarah Mitchell

Published: January 1, 2021

In today's fast-paced business environment, financial agility is no longer optional, it's essential for competitive advantage.

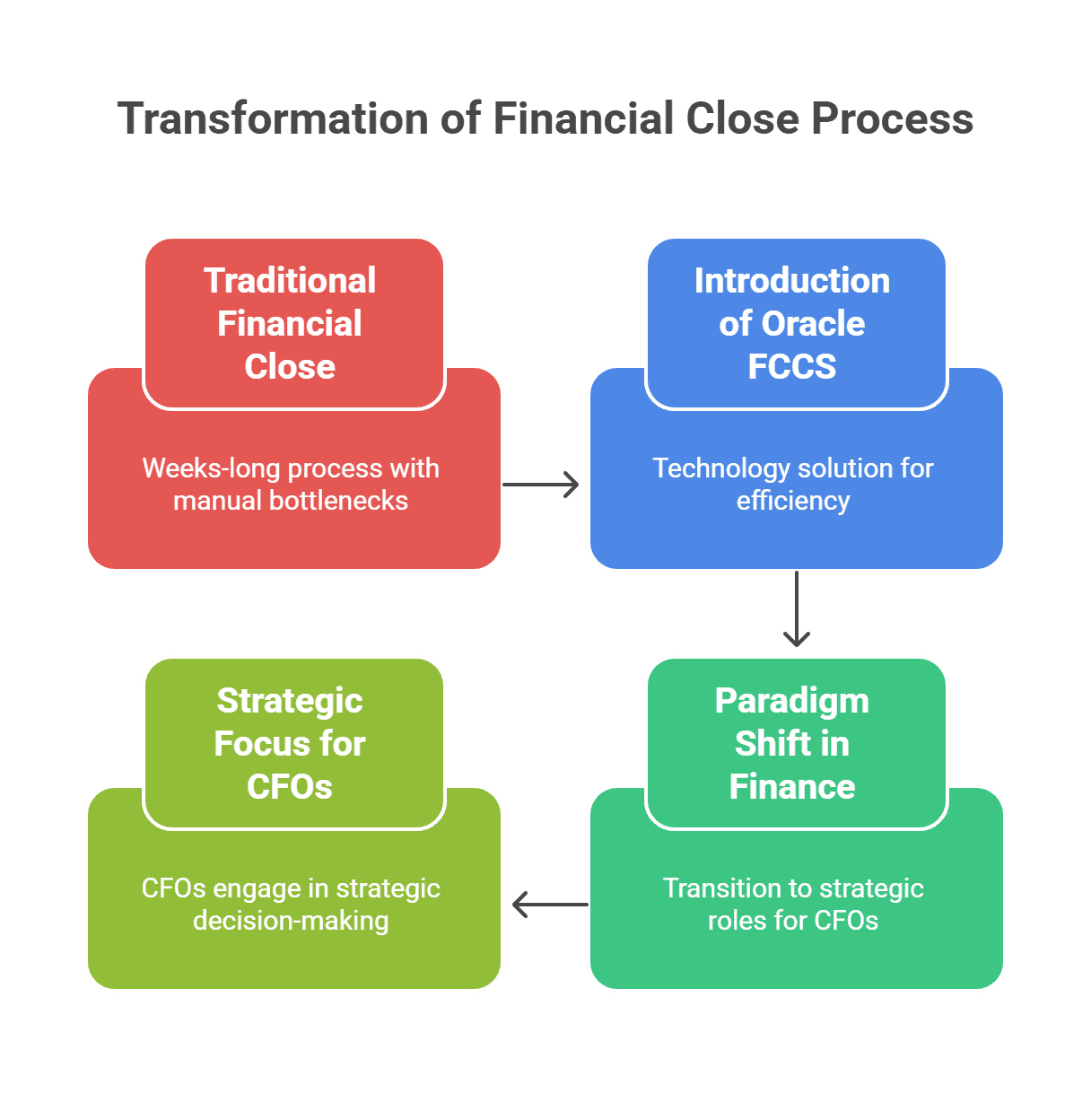

Chief Financial Officers (CFOs) are increasingly recognizing that traditional financial close processes, which often stretch into weeks, represent a strategic impediment to their organizations.

This blog post explores how Oracle Financial Consolidation and Close Cloud Service (FCCS) is helping finance leaders transform lengthy close cycles into streamlined processes completed in days, not weeks.

The Financial Close Challenge: Why Traditional Approaches Fall Short

Manual Bottlenecks and Error Proliferation

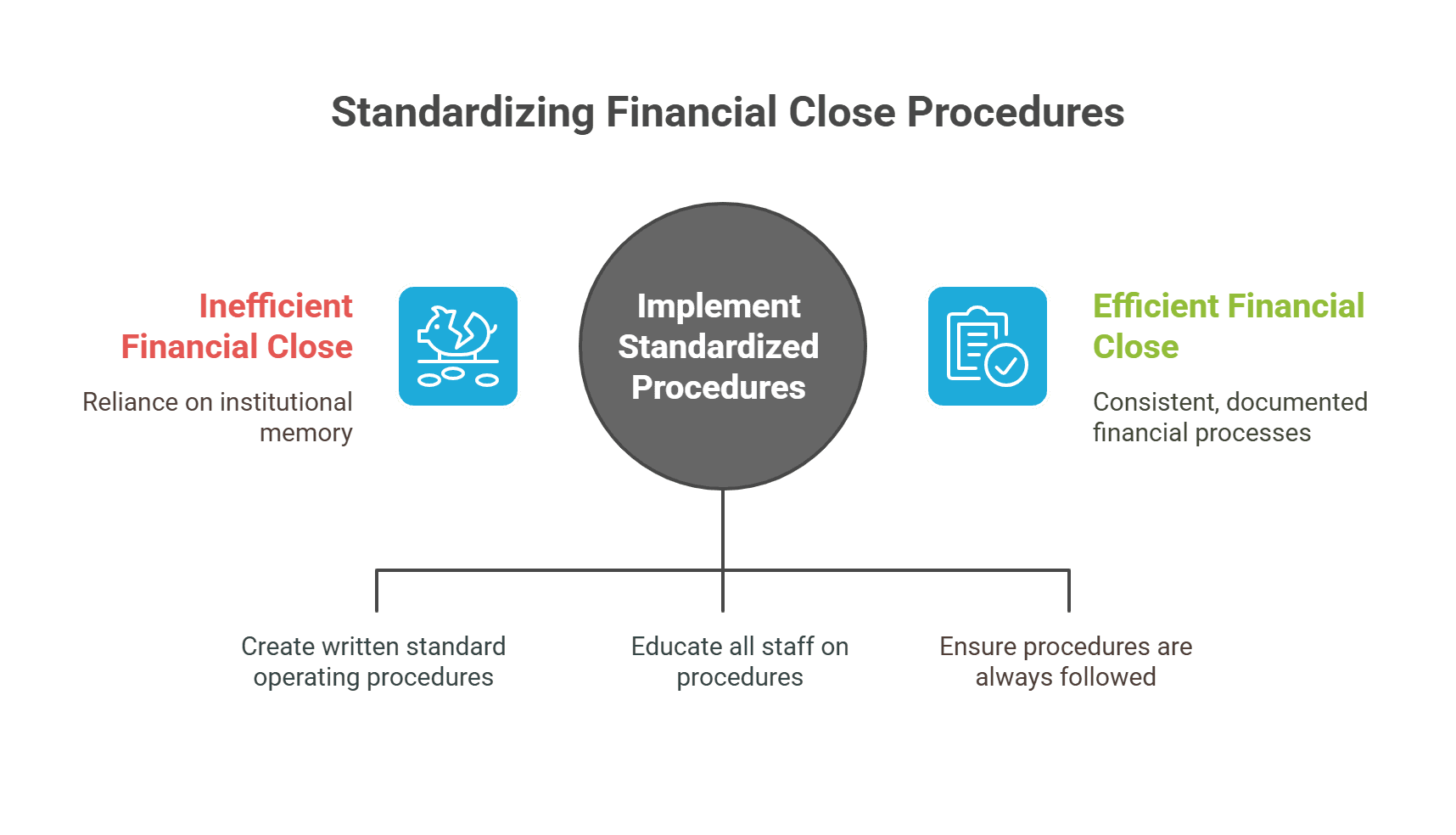

Many organizations still rely heavily on "institutional memory" rather than standardized procedures for their financial close. This dependence on undocumented processes creates inconsistencies and significant inefficiencies across departments.

The close process becomes burdened by extensive manual data entry, which is highly susceptible to human error, creating substantial administrative overhead and stress for finance teams.

When critical processes exist only in the minds of experienced individuals, organizations face considerable vulnerability to:

- Staff turnover

- Knowledge loss

- Inconsistent execution

- Scaling limitations

Fragmented Data and Limited Visibility

A pervasive challenge in traditional environments is the use of disparate tools for various financial functions. This fragmented technological landscape creates isolated data silos, making it exceedingly difficult to consolidate information and reconcile accounts accurately during the close period.

Finance teams frequently contend with a severe lack of real-time visibility into company spending and other critical financial data. This "data lag" means CFOs receive financial reports weeks after the period close, severely compromising their capacity to make timely, informed decisions.

Impact on Strategic Performance

The consequences of inefficient close processes extend far beyond internal frustrations:

- Compliance risks: Manual processes lead to inaccuracies in financial statements

- Delayed strategic insights: Finance teams consumed by mechanical aspects have less time for analysis

- Productivity and morale impact: Teams perpetually burdened by manual tasks experience burnout

- Stakeholder relationship strain: Delayed reporting erodes investor confidence

Oracle FCCS: Transforming the Financial Close Landscape

What is Oracle Financial Consolidation and Close Cloud Service?

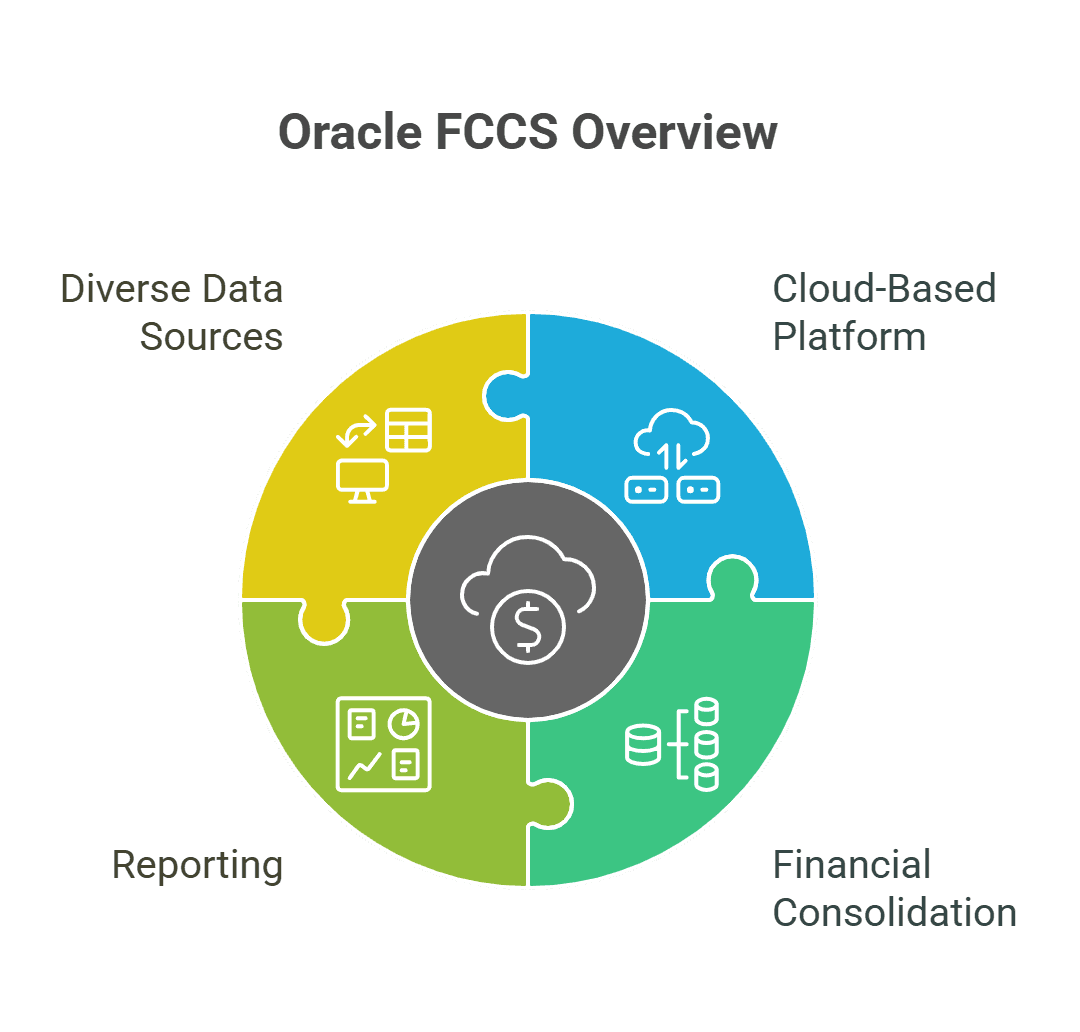

Oracle FCCS is a comprehensive cloud-based financial consolidation and reporting platform specifically engineered to enable enterprises to manage and combine financial data from diverse sources within a unified environment.

As a foundational module within Oracle's Enterprise Performance Management (EPM) Cloud suite, it offers a holistic approach to planning, budgeting, and forecasting.

How Oracle FCCS Accelerates the Close Cycle

Intelligent Automation: The Speed Engine

Oracle FCCS dramatically accelerates the financial close through sophisticated automation:

- Automated data validation: Eliminates manual data mapping and reconciliation

- Streamlined intercompany eliminations: Reduces a process that typically takes 3-4 days to less than an hour

- Automated currency conversions: Enables accurate consolidation of multi-currency data

- Intelligent Process Automation (IPA): Orchestrates the entire close process with minimal human intervention.

Connected Finance: The Data Foundation

A cornerstone of acceleration is creating a truly connected finance environment:

- Shared, real-time data: Ensures proper mapping across ERP, EPM, and operational platforms

- Enterprise Data Management (EDM): Establishes a single "golden source" of truth

- Enhanced data integrity: Builds confidence in the reported numbers and significantly improves audit readiness Source

Enhanced Reporting and Analytics: Beyond Numbers

FCCS significantly enhances financial reporting quality and timeliness:

- Comprehensive reporting tools: Includes financial statements, variance analysis, and KPI dashboards

- Multi-GAAP reporting: Incorporates pre-configured models for global reporting requirements

- AI-powered analytics: Extends capabilities to predictive and prescriptive insights Source

Curious if Oracle Cloud EPM would actually work in your real-world setup? Let’s build a small-scale test and find out. Contact us for a no-pressure POC.

Strategic Benefits: Why CFOs Are Choosing FCCS

Empowering Faster, More Informed Decisions

Reduced closing times provide organizations with significantly faster access to critical information about corporate performance. This expedited access enables management to quickly identify and address problem areas, leading to more agile business decisions.

This represents a fundamental shift from a "rearview mirror" view of financial performance to a "windshield view" that enables:

- Identifying emerging trends

- Assessing immediate impact of recent events

- Adjusting strategies in near real-time

Significant Time and Cost Savings

An efficient financial close process substantially reduces time dedicated to:

- Manual interventions

- Error reconciliation

- Variance analysis

- Data processing and collection

Organizations implementing Oracle FCCS have experienced an average return on investment (ROI) of 305% over five years, with a remarkably short payback period of just over one year.

Freeing Finance for Strategic Analysis

By streamlining the financial consolidation process, organizations free up substantial time for their accounting and finance staff. This liberation allows them to contribute greater depth and value to written reports and ad hoc financial analysis, enhancing decision-making across the enterprise.

This elevates finance from a back-office function to a strategic partner providing critical insights for:

- Sophisticated scenario modeling

- Detailed profitability analysis

- Strategic capital allocation

- M&A due diligence

Real-World Success: From Weeks to Days

Luceco's Transformation: 12 Days to 5 Days

Before implementing Oracle FCCS, manufacturing company Luceco faced significant challenges:

- Financial consolidation, currency translations, and intercompany processes relied on manual spreadsheets

- Multiple source systems and disparate charts of accounts across geographies

- Consolidation process alone consumed 12 days

After implementation, Luceco achieved:

- Consolidation reduced from 12 days to 5 days

- 70% time-efficiency saving across the entire finance function

- Intercompany eliminations reduced from 3-4 days to less than an hour

- Full data consolidation now takes only 10 minutes Source

Lyft's Financial Close Halved

Lyft successfully leveraged Oracle Cloud applications to establish a single source of information across finance and operations. This strategic unification yielded:

- Financial close time cut in half

- Faster data delivery to stakeholders

- Enhanced transparency and decision-making agility Source

Industry-Wide Improvements

Finance professionals utilizing Oracle FCCS have reported:

- Average 45% reduction in financial consolidation and close time

- 91% reported improved visibility into financial data

- 84% noted improved accuracy of financial data

- 75% confirmed improved compliance with regulatory requirements

- 20% reduction in audit costs Source

Curious if Oracle Cloud EPM would actually work in your real-world setup? Let’s build a small-scale test and find out. Contact us for a no-pressure POC.

Implementation Best Practices: Ensuring Success

Define and Standardize Close Processes

A successful implementation requires organizations to meticulously define and standardize existing close processes.

This ensures that automation is built upon solid, consistent, and optimized processes rather than merely digitizing existing inefficiencies.

Leverage Out-of-the-Box Functionality

Oracle FCCS accelerates deployment through pre-built content and dynamic calculations. Leveraging these built-in best practices can fulfill a significant portion of requirements without extensive customization while remaining upgradable to new Oracle releases.

Ensure Data Quality and Integration

High data quality and robust integration with source systems are critical for success. Utilizing Enterprise Data Management solutions helps rationalize master data structures and facilitate comprehensive data governance, ensuring shared, properly mapped, and real-time data across all systems.

Conclusion: The Future of Financial Close is Fast, Accurate, and Strategic

The transformation from a weeks-long financial close to one completed in days represents a fundamental paradigm shift in finance's role. Oracle FCCS stands at the forefront of this transformation, empowering CFOs to transcend operational burdens and embrace truly strategic roles.

By significantly accelerating the financial close, finance leaders can focus on:

- Evaluating reinvestment opportunities

- Attracting and cultivating talent

- Engaging in proactive planning that shapes the company's future

The financial close process no longer needs to be a dreaded period characterized by stress and late nights. By embracing automation, standardization, and centralized financial management platforms like Oracle FCCS, organizations achieve a faster, more accurate, and profoundly more efficient close cycle.

For today's CFOs, the digital financial close isn't just an operational improvement, it's a strategic imperative for competitive advantage in an increasingly dynamic business landscape.

Curious if Oracle Cloud EPM would actually work in your real-world setup? Let’s build a small-scale test and find out. Contact us for a no-pressure POC.

FREE CONSULTATION

Schedule your Free Consultation, to see it in action!

We offer Autonomous Systems for EPM Cloud Applications such as Oracle Planning & Budgeting Cloud Service (PBCS/EPBCS), Financial Close & Consolidations Cloud Service (FCCS), Enterprise Data Management Cloud Services (EDMCS), Account Reconciliation Cloud Service (ARCS), Profitability & Cost Management (PCM) and more.