The Best of Account Reconciliation

By: Zarek Bowen - Principal Consultant

Published:

September 8, 2020

The Challenge

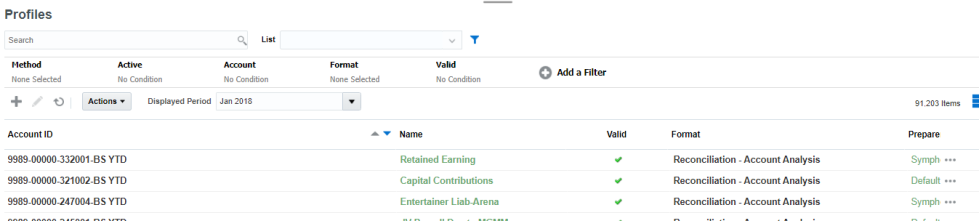

A certain client has an expansive base of accounts ranging from operations and workforce to point-of-sale and accounts receivable or payable. This is natural for any sizable business, and alongside it comes the need for tracking and reconciliation. In this case, a solution in which the reconciliation process was automated and streamlined was requested. With this sizable chart of accounts (CoA) and a list of specified requirements we were able to implement a solution using Oracle’s Account Reconciliation Cloud Service (ARCS) where 90,000+ profiles for reconciliation could be managed and administered with the touch of a button.

The Solution

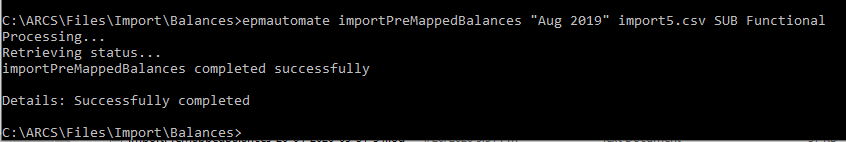

The clients CoA already present within Enterprise Resource Planning (ERP) and Fusion GL, and implementations already achieved with Financial Consolidation and Close Cloud Services (FCCS). Using this framework to accompany the process we achieved the final product via an interlinking web of these services, automated and simplified using tools like EPMAutomate and other scripts. Here we will show the detail and the process we went through for this application to be a success.

At its core, the needs were that the client’s cash flows needed to be reconciled and tracked at various levels of operation. This is the basis or ARCS as a service, each of these are reconciled on an account by account basis using profiles designated for each target of account, entity, dept. Further though, each account has specifications needed based on the account type and we were able to create formats to accommodate. These formats we create then lead to the creation of reconciliations, where users can view and make use of the reconciliation process.

One of these specifications was a comparison of budget versus the actual spending of a series of accounts for tracking how close operations stay within budget expectations. Another such is a variance analysis, which tracks the account activity based on a prior period for comparison and explanation. For other accounts we run comparison of the MTD or YTD balance sheet vs the income statements as sub and source systems. At the POS level, we implemented Transaction Matching to reconcile at the transaction level for credit card and sectional charges.

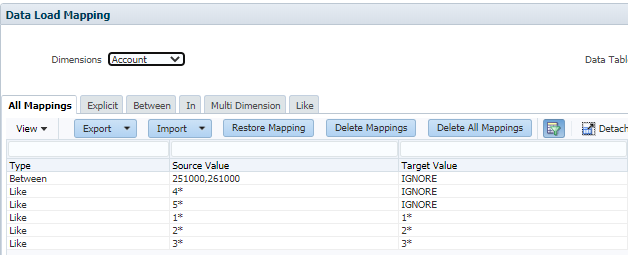

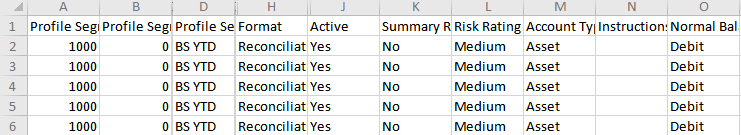

The data loaded into the application is done via a series of integrations we have woven into the fabric. Data Management as a tool comes standard, and we use it to connect to our clients other platforms such as ERP and FCCS. Information is taken from each in the form of balances or profile information for each respective part of the reconciliation process.

The Results

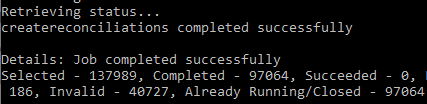

In the end, our process was as such: An EPM Automate script executes three courses of action. Files are fetched from the FCCS and ERP as reports and imported into the application. This information is loaded into the profiles on a period basis and reconciliations are created. Following this, in-app automation runs. This being the business rules lain to reconcile accounts based on various parameters. This process is tracked and reported as part of the automated script and logs are stored for updates which can be emailed to the user. Upon completion of the script, profiles and balances are updated and auto-reconciled accounts are closed, and reconciliation for users can begin. To emphasize one last time, this is done at the click of a button.

Feel free to contact us for more information.

FREE CONSULTATION

Schedule your Free Consultation, to see it in action!

Contact Us!

We offer Autonomous Systems for EPM Cloud Applications such as Oracle Planning & Budgeting Cloud Service (PBCS/EPBCS), Financial Close & Consolidations Cloud Service (FCCS), Enterprise Data Management Cloud Services (EDMCS), Account Reconciliation Cloud Service (ARCS), Profitability & Cost Management (PCM) and more.